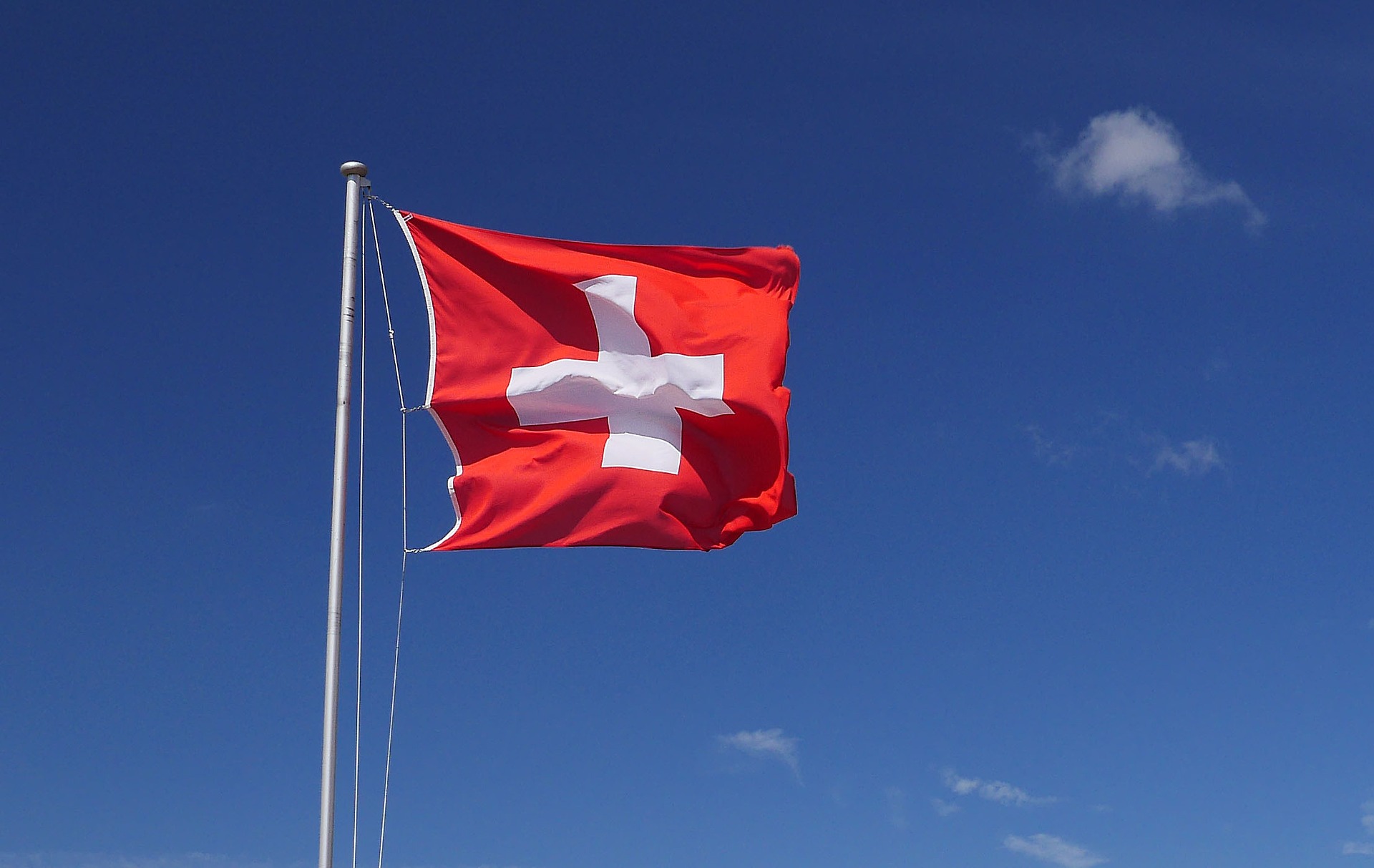

Requirements under the Program

- Possible to get residence permit in Switzerland, upon paying an `annual lump sum taxation` fee – a minimum of CHF 150’000 (approx. USD 170’000) or more, depending on swiss canton except Zurich.

- This annual tax fee may go up to CHF 1 million or more depending on the canton and it is irrespective of family of worldwide income or assets.

- The swiss residence permit is offered to persons of various categories under retirement, wealthy individuals, or as a Business employee where it normally involves in setting up a swiss company.

- By paying this fee, there is no need to declare worldwide income and assets.

Benefits of Switzerland Lump Sum Taxation Program

Switzerland has the second highest gross domestic product (GDP) per capita in the world.

Has the lowest rate of value-added tax in Europe. 8% is levied on most goods and services, 3.8% on accommodation services, and 2.5% on basic necessities and other everyday items.

It is a multi-national country, open to foreigners; currently more than 20% of the population is made up of resident and temporary foreign workers having four official languages, including German, French, Italian and English.

The Swiss property market is trusted and has been known for its stable growth over the last 40 years.

Switzerland is not only a safe country; it also has a history for neutrality and is home to one of the most stable democracies in the world.

A Swiss residence permit allows one to buy real estate property such as an apartment home without securing any prior approvals from the authorities in Switzerland.

The country has a very sound healthcare system with high life expectancy, 79 years for men and 84 years for women.

GET IN TOUCH WITH

OUR PROFESSIONAL TEAM